Wealth management at its finest.

Presenting The Reserve – a customized program from 360 ONE Wealth to cater to the unique wealth needs of HNIs. Giving you the best of both worlds – the personal attention of a dedicated Relationship Manager and the agility of cutting-edge technology.

Get The Reserve edge

Get The Reserve edge

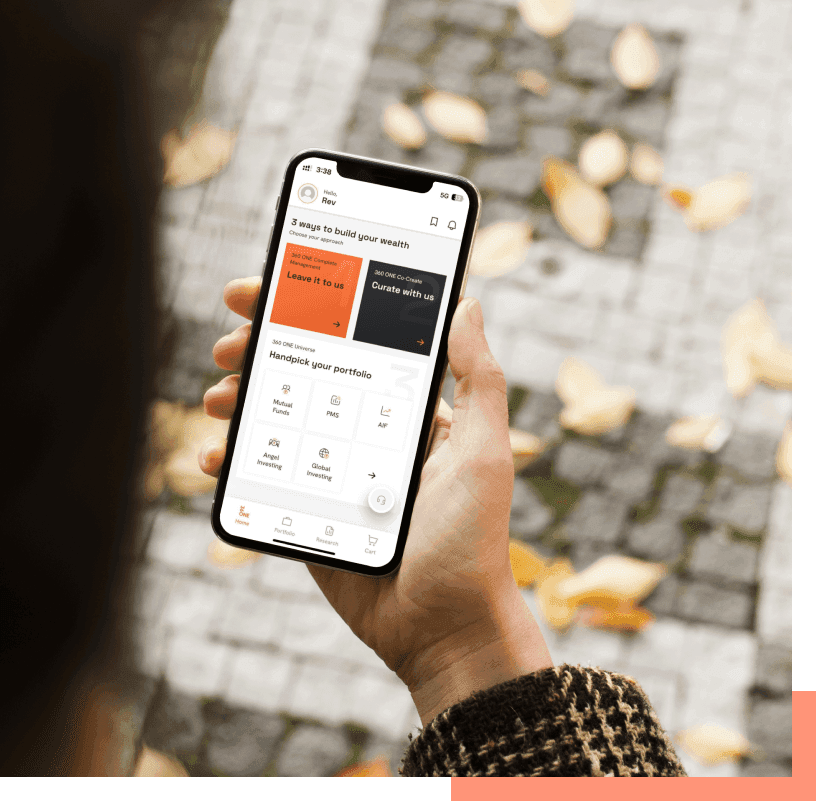

3 bespoke ways to invest with us.

Handpick your portfolio

For those who prefer to take the lead, the highly curated list of investment products on our app allows for you to confidently go ahead and make your own investment choices.

Leave it to us

If you’d prefer to have us choose for you, our expert team will curate an investment portfolio, best suited to your needs.

Curate with us

And for those who’d like a bit of both, that’s on the table too.

Your Partner for Holistic Wealth Management.

At The Reserve, we understand that true wealth management is never only about investment guidance. Our array of additional services will help with your wider wealth needs too.

Global Investing

Expand your portfolio with diverse opportunities across international markets.

Lending Services

Lending solutions tailored to your strategic wealth creation needs.

Wills

Seamlessly distribute your assets to next generation through will creation.

Early-stage Investing

Receive expert guidance on early-stage investments.

Accreditation

Avail reduced minimum investments in PMS and AIFs, making exclusive opportunities more accessible.

Specialized Insurance

Protect your wealth with customized insurance solutions designed to safeguard your assets.

Immigration Services

Advisory services to facilitate investment-based immigration.

A Homeground of 17 Innovation-rich & Award-rich years.

360 ONE Wealth is a trusted partner to many of India’s leading business families & corporates. It has been a much awarded leader in wealth management and private banking for over 17 years.

The Reserve

A specialized program from 360 ONE Wealth springboards off this wealth of experience, innovation and wisdom to bring you services that understand your needs and to guide you as you build your assets.

Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge.

Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month.

KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

No need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorize your bank to make payment in case of allotment. No worries for refund as the money remains in investor's account.

SEBI Regn. No. : Broking INZ000296339 / DP-IN-573-2021 / RA - INH000011431 / ARN - 181727

National Stock Exchange of India Ltd. Member Code: 90070

Bombay Stock Exchange Ltd. Member Code: 6633

Multi Commodity Exchange of India Ltd. Member Code: 55860

National Commodity & Derivatives Exchange Ltd. Member Code: 1239

© 2026 360 ONE WAM LIMITED

All rights Reserved.