Your Wealth,

Aligned To Your Goals

At 360 ONE Wealth, understanding your aspirations, aligning our strategies to your goals and being available whenever you need us, comes naturally. We have the privilege of working alongside India’s most distinguished individuals and families to grow and preserve their wealth and legacy. Our disciplined, client-centric approach is validated by strong results and a team that is focused squarely on you.

Our Investment Approach

As long-term partners in your journey, aligning with your vision is the first step we take towards building trust.

01

Open Architecture

Our unbiased open architecture offers you access to thoroughly vetted opportunities for stability and growth, managed with rigor and transparency.

02

Investment Policy Statement

Our tailored Investment Policy Statement (IPS) reflects your vision and risk tolerance and sets guardrails within which your advisors can operate.

03

Bespoke Planning

Cookie-cutter investment plans don’t belong here. Our advisors take the time to understand your financial situation, objectives and the values that guide you and your family.

04

Strength of Our Investment Process

Financial success is driven by precision. Our client engagement teams are supported by a seasoned team of portfolio strategists and product experts across asset classes.

05

Alignment of Interest

Good business is built on win-win partnerships, free from conflicts of interest. With our unique proposition, we fully align with our clients' interests, firmly ensuring we are on your side of the table.

06

Portfolio Review & cutting-edge analytics

Our exclusive portfolio analysis platforms and tools keep you in control of your portfolio, facilitating informed decision-making.

Why choose 360 ONE Wealth

One of India's leading pure-play wealth management firms with award-winning service

Benefit from pioneers and product experts across asset classes

Preferential access to unique, value-added investment products ahead of the market

One of the largest in-house research teams focused on delivering risk-adjusted alpha

Access to bespoke solutions aligned with your long-term vision

360-degree view of your portfolio to enhance decision-making

Ready to build your bespoke portfolio?

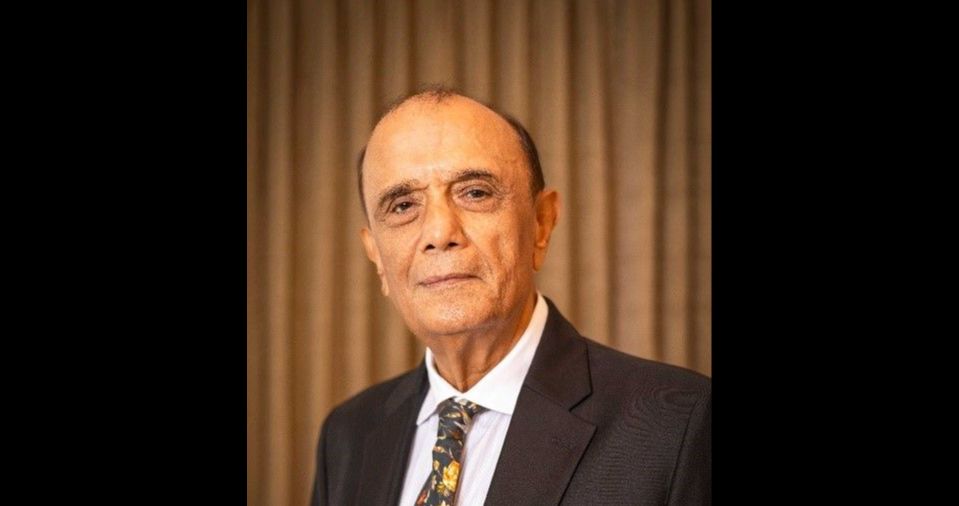

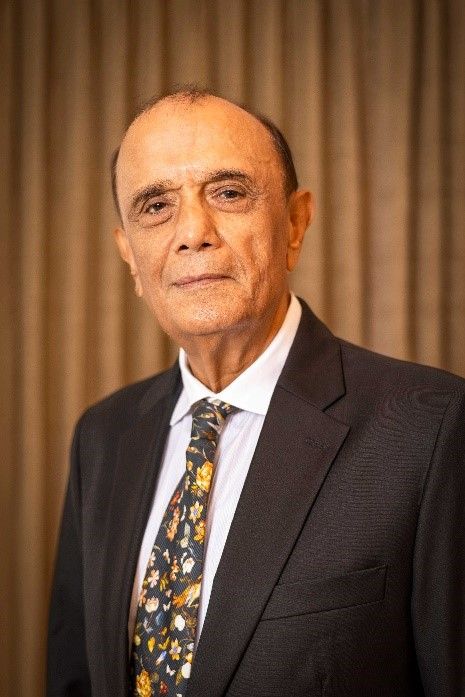

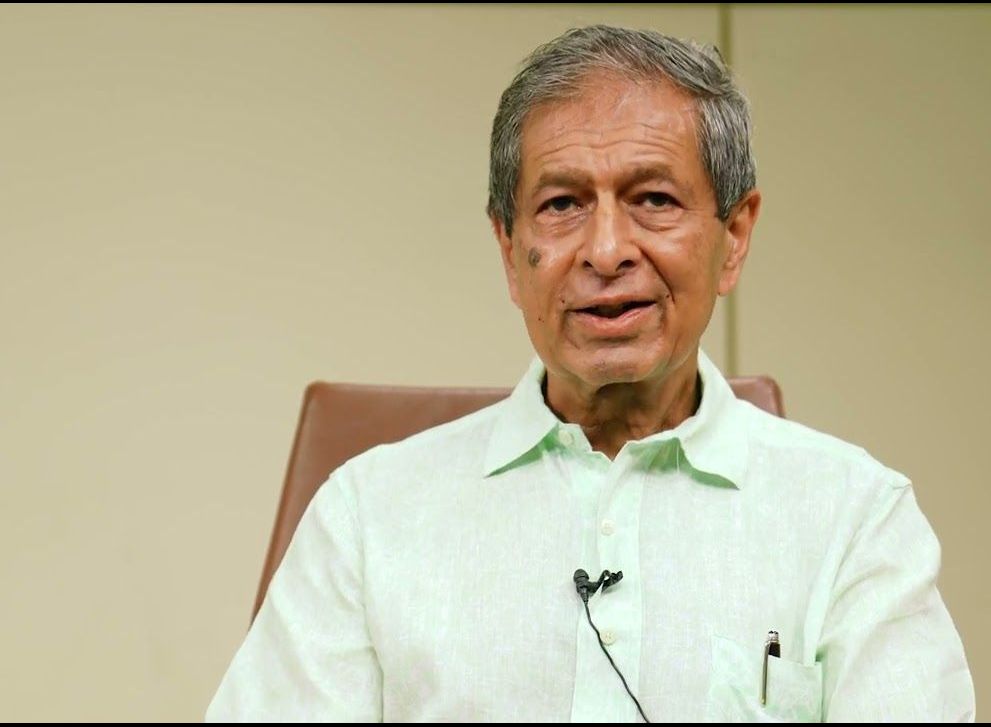

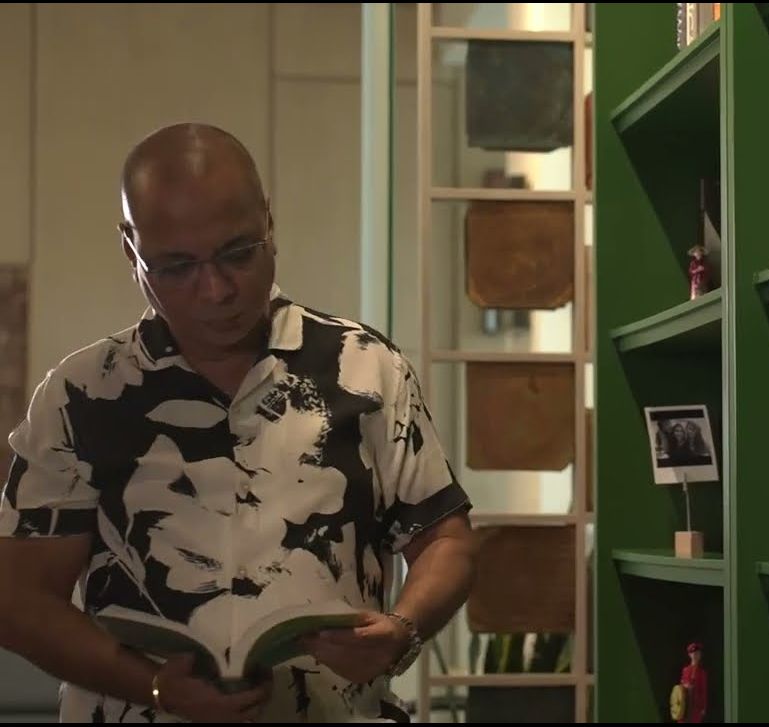

Voice of Our Clients

1 / 5

1 / 5

Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge.

Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month.

KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

No need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorize your bank to make payment in case of allotment. No worries for refund as the money remains in investor's account.

SEBI Regn. No. : Broking INZ000296339 / DP-IN-573-2021 / RA - INH000011431 / ARN - 181727

National Stock Exchange of India Ltd. Member Code: 90070

Bombay Stock Exchange Ltd. Member Code: 6633

Multi Commodity Exchange of India Ltd. Member Code: 55860

National Commodity & Derivatives Exchange Ltd. Member Code: 1239

© 2026 360 ONE WAM LIMITED

All rights Reserved.