Do any of these questions keep you up at night?

Are my children prepared to take on the mantle?

How do I protect my personal assets from business risks?

How do I ensure harmony in the family in the event of a wealth transfer?

How do I make more time for things that matter to me, beyond my core responsibilities?

How do I know that the team to whom I am entrusting my legacy is doing right by me?

Focus on what matters to you, with a Professionally Managed Family Office

At 360 ONE Wealth, we understand the intricate demands that accompany business families. Our Family Office solutions are designed to professionalise and strategise all aspects of your family, wealth, and legacy. By entrusting us with the complexities, you can experience the liberating feeling of focusing on what really matters: cherishing quality time with your family, nurturing your core business, and safeguarding your well-being.

The 360 ONE Wealth

Family Office Solution Suite

Our strategic offerings across all aspects of your wealth, family, and legacy can become a force multiplier for growing and sustaining your family business.

Wealth creation is your forte; let us help you grow and preserve it. Based on an understanding of your business vision, we set up an investment governance framework and craft a custom Investment Policy Statement (IPS) that outlines strategies for safeguarding and enhancing your wealth.

Investment Management

Tax Planning

Trusts & Estates

M&A Assistance

17+ Years

of Wealth management experience

8,500+

UHNW & HNW families and corporates served

₹ 7,11,398 Cr

(US$79 Bn) in assets under management

175+ Awards Won

A testimony to our excellence in wealth management

Preserve your wealth and values with a professional family office

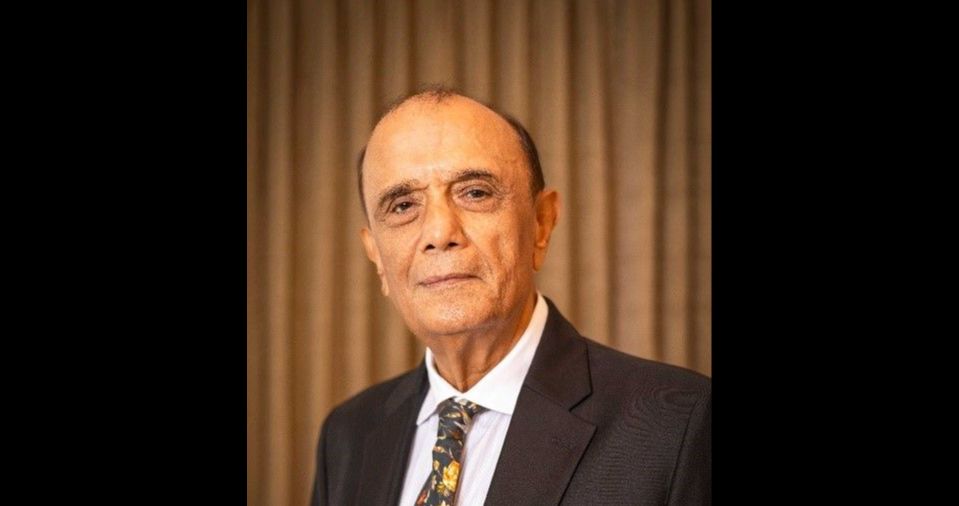

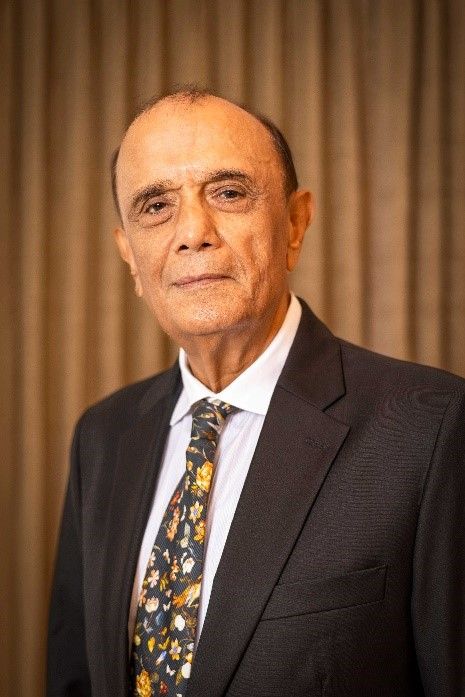

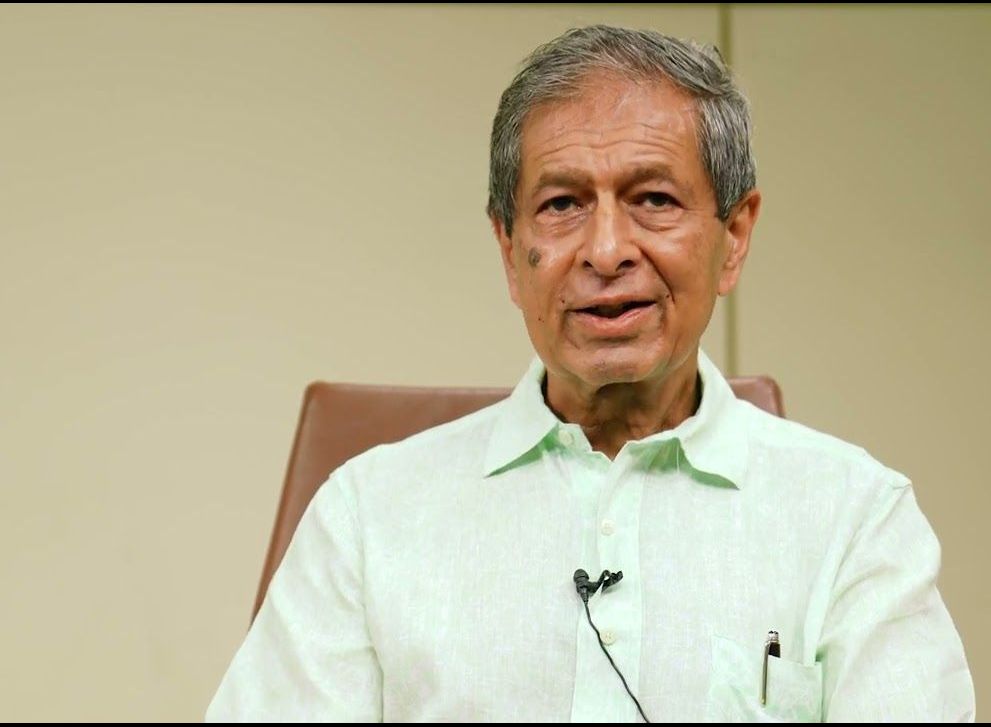

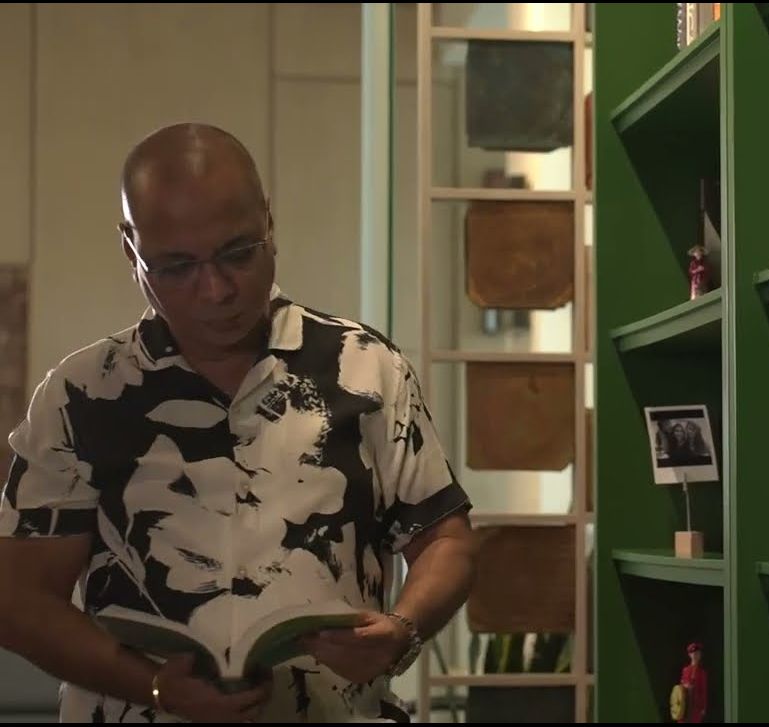

Voice of Our Clients

1 / 5

1 / 5

Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 01, 2020.

Update your email id and mobile number with your stock broker / depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge.

Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month.

KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.

No need to issue cheques by investors while subscribing to IPO. Just write the bank account number and sign in the application form to authorize your bank to make payment in case of allotment. No worries for refund as the money remains in investor's account.

SEBI Regn. No. : Broking INZ000296339 / DP-IN-573-2021 / RA - INH000011431 / ARN - 181727

National Stock Exchange of India Ltd. Member Code: 90070

Bombay Stock Exchange Ltd. Member Code: 6633

Multi Commodity Exchange of India Ltd. Member Code: 55860

National Commodity & Derivatives Exchange Ltd. Member Code: 1239

© 2026 360 ONE WAM LIMITED

All rights Reserved.