The Journey to 360 ONE.

We are committed to placing your needs first, always. We do this through our steadfast focus on delivering performance in the long-term. Beyond performance, our personalized, innovation-led approach and responsive culture enable us to offer you that extra edge.

We are 360 ONE

We embody the 360 ONE promise every day, through our actions. Our culture gives us the confidence on driving continued success and value creation for all our stakeholders. We believe, embrace, and live these values and behaviours every day

Client-centric

Our single-minded focus is on our clients, always. We care, we listen, we learn, and we execute to deliver beyond client expectations.

Entrepreneurial

We have extreme ownership from ideation to execution. We are innovative, agile and outcome oriented.

Right in spirit and letter

We do what is right over what is easy, for our clients, fellow employees, and stakeholders. We are transparent, honest, and courageous.

People-oriented

We are inspired, collaborative and inclusive. Above all, we respect each other as individuals, colleagues and stakeholders working towards the same goal.

Change Champions

We embrace and accept change. We are driven by passion and a positive attitude. We seek opportunities to continuously learn and grow.

Rigorous & Risk-Conscious

We are thorough & analytical in our decision-making for clients & our own business. Our enhanced risk awareness & robust governance mechanism helps navigate through all scenarios.360 ONE Leadership

Our culture of high performance and personalized attention have been founding principles throughout our journey over the last 17 years. Our leadership has been instrumental in shaping our client-centric approach since inception.

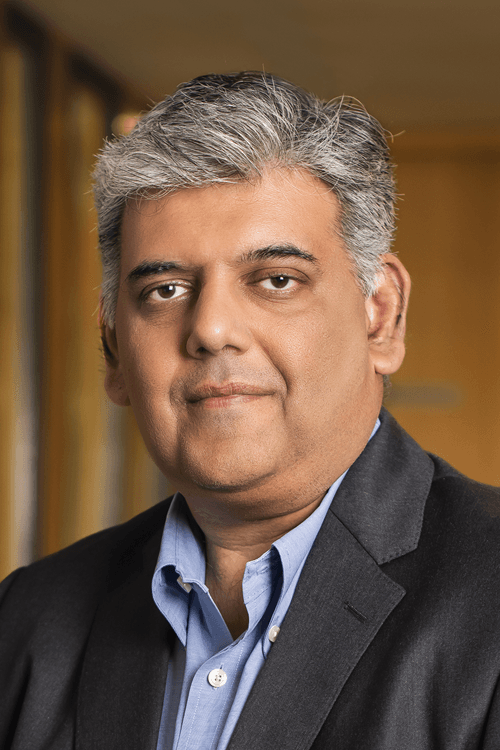

Karan Bhagat

Founder, MD and CEO, 360 ONEKaran has more than two decades of experience in the financial services industry. He provides direction and leadership towards the achievement of 360 ONE's strategic goals and objectives. He has built a team of talented professionals, who work with and for some of the most distinguished family offices, institutions and wealthy families in India and abroad

THE 360 ONE Story

We are proud of our roots and the journey that we have traversed so far. Today, we are one of India's largest asset and wealth management firms with an AUM of around US$ 79 billion. Our new identity reflects our founding principles and commitment to strong relationships. We look back to where we started from, even as we forge ahead to where we want to go.

Recognition and Accolades

Awards are a validation of the trust that you have in 360 ONE. We have been honored with over 175 awards - a testament to the strength of our relationships as well as our offerings.

India's Best Wealth Manager

Euromoney Private Banking Awards 2025

Best Domestic Private Bank – India

Asian Private Banker’s 14th Awards for Distinction

Best Private Bank – India

The Asset Triple A Private Capital Awards 2025

Best Private Bank – India

FinanceAsia Awards 2025

THE 360 ONE Foundation

Outcome-based, pay-for-success, co-pay paradigm

We provided best-in-class training and pan-India placement to underprivileged youth from Jharkhand. Improved leverage through co-funding resulted in 2.5X students getting trained and placed, and up to 4X increase in their earnings. Partner: PARFI

Smart financing solution

We contributed to a ‘zero-interest revolving grant’ that provided cash flow and access to working capital for vulnerable women artisans who lacked creditworthiness and financial footprint to afford loans from mainstream providers. Capacity building training, access to raw materials and market linkages were also offered. Partners: Collective Good Foundation & Industree Foundation.

Financial literacy & behavioural change program

Improved borrowing behaviour is a matter of consistent practice and discipline. This financial literacy & inclusion program provided nano and micro entrepreneurs training and access to commercial capital, coupled with positive communication nudges and incentives for timely repayment of loans and good credit behaviour. Partners: Collective Good Foundation & Arth.

Fintech incubator for inclusive finance start-ups

We entered into a partnership with India’s leading inclusive fintech incubation platform at IIM-A called CIIE.CO that provides transformational support to inclusive lending start-ups that serve low- and middle-income segments. Partner: CIIE.CO

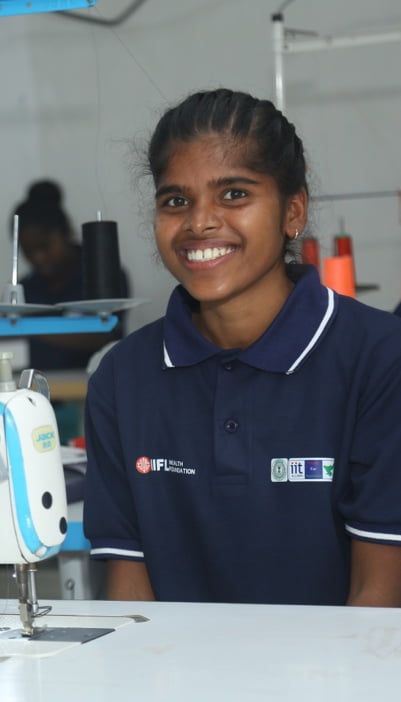

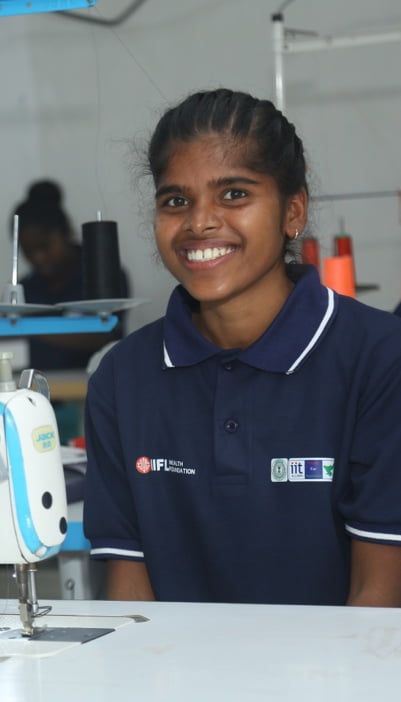

Outcome-based, pay-for-success, co-pay paradigm

We provided best-in-class training and pan-India placement to underprivileged youth from Jharkhand. Improved leverage through co-funding resulted in 2.5X students getting trained and placed, and up to 4X increase in their earnings. Partner: PARFI

Smart financing solution

We contributed to a ‘zero-interest revolving grant’ that provided cash flow and access to working capital for vulnerable women artisans who lacked creditworthiness and financial footprint to afford loans from mainstream providers. Capacity building training, access to raw materials and market linkages were also offered. Partners: Collective Good Foundation & Industree Foundation.

Financial literacy & behavioural change program

Improved borrowing behaviour is a matter of consistent practice and discipline. This financial literacy & inclusion program provided nano and micro entrepreneurs training and access to commercial capital, coupled with positive communication nudges and incentives for timely repayment of loans and good credit behaviour. Partners: Collective Good Foundation & Arth.

Fintech incubator for inclusive finance start-ups

We entered into a partnership with India’s leading inclusive fintech incubation platform at IIM-A called CIIE.CO that provides transformational support to inclusive lending start-ups that serve low- and middle-income segments. Partner: CIIE.CO

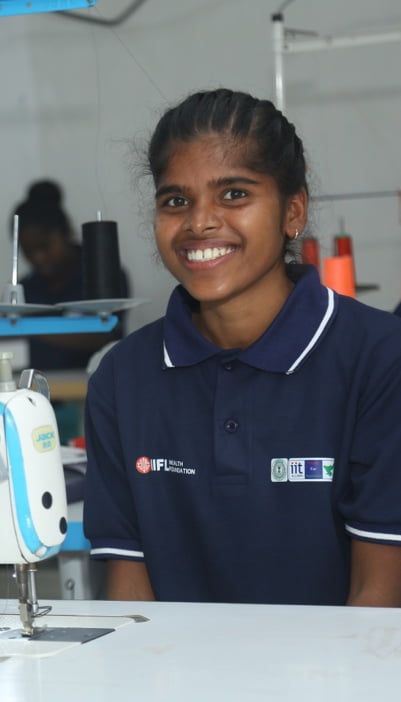

Outcome-based, pay-for-success, co-pay paradigm

We provided best-in-class training and pan-India placement to underprivileged youth from Jharkhand. Improved leverage through co-funding resulted in 2.5X students getting trained and placed, and up to 4X increase in their earnings. Partner: PARFI

Smart financing solution

We contributed to a ‘zero-interest revolving grant’ that provided cash flow and access to working capital for vulnerable women artisans who lacked creditworthiness and financial footprint to afford loans from mainstream providers. Capacity building training, access to raw materials and market linkages were also offered. Partners: Collective Good Foundation & Industree Foundation.

Financial literacy & behavioural change program

Improved borrowing behaviour is a matter of consistent practice and discipline. This financial literacy & inclusion program provided nano and micro entrepreneurs training and access to commercial capital, coupled with positive communication nudges and incentives for timely repayment of loans and good credit behaviour. Partners: Collective Good Foundation & Arth.

Fintech incubator for inclusive finance start-ups

We entered into a partnership with India’s leading inclusive fintech incubation platform at IIM-A called CIIE.CO that provides transformational support to inclusive lending start-ups that serve low- and middle-income segments. Partner: CIIE.CO