NFO - DynaSIF Equity Long-Short Fund

An open-ended equity investment strategy investing in listed equity and equity related instruments including limited short exposure in equity through derivative instruments.

Invest Now6 February 2026

What is a Specialised Investment Fund (SIF)?

An SIF is a new category of investment product introduced under the SEBI (Mutual Funds) Regulations, 1996, via amendment, enabling mutual fund-AMCs to launch investment strategies that lie between traditional mutual funds and portfolio-management services (PMS). SIFs aim to blend mutual fund benefits (like tax efficiency) with PMS-like strategy, allowing for long/short strategies, sector rotation, and tactical asset allocation, providing sophisticated options for experienced investors.

Know More

Discover DynaSIF

A portfolio structure that includes both long and short position to enhance alpha

Active management of allocations in response to changing market opportunities, while managing risk

Using advanced tools for hedging and reducing market volatility

Carefully chosen portfolios across equity, debt and hybrid categories for addressing diverse investor needs, goals and risk profiles

Core Pillars of DynaSIF

Dynamic Allocation: Adjusted as per market conditions and opportunities

Multi-Asset Diversification: Across equities, debt, derivatives, REITs, and private instruments

Focus on Consistent Compounding: Emphasis on sustainable, long-term growth

Active Risk Management: Tactical long/short positions and hedging strategies

Research-Driven Selection: Based on deep fundamental and quantitative analysis

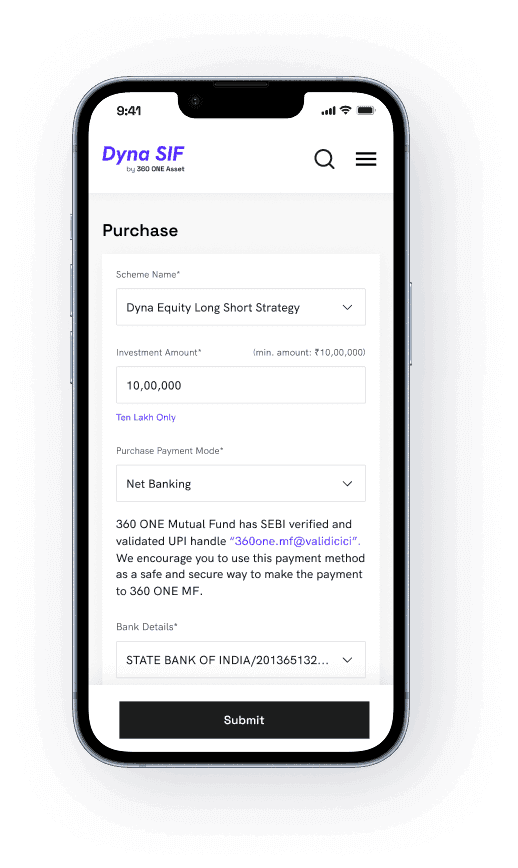

How To Invest

Enter your Basic Details

Add your Personal Information

Fill your Investment Details

Create Bank Mandates

Summary & Payments

Who Should Invest

For risk aware investors seeking higher risk-adjusted returns, SIFs offer a tailored path to diversify across markets phases and capitalize on emerging opportunities both on the long and short side.

How SIFs Stack Up Against Other Investment Avenues

*As per current Income Tax Laws. Please consult your investment / tax adviser before making any investment decision